Enterprise marketers are using call analytics platforms to collect, analyze and act upon the growing volume of caller data from the billions of inbound calls to businesses. They make it possible to automate and scale call tracking, as well as recording, scoring, routing and fraud prevention.

But deciding whether or not your company needs a call analytics platform is no simple task. It requires the same evaluative steps involved in any software adoption, including a comprehensive self-assessment of your organization’s business needs, staff capabilities, management support and financial resources.

Before jumping in, gather your team and answer these 10 questions to help you decide if these platforms are right for your organization.

Are we optimizing inbound phone calls as a sales or lead-generating channel?

The phone continues to play an integral role in customer communications, particularly as more consumers work and shop from home. An Ipsos report commissioned by Google found that 70% of mobile searchers have used click-to-call capabilities to connect with a business.

How much of our revenue (if any) do we attribute to inbound phone leads?

If the revenue you are already attributing to inbound calls is greater than the cost of the platform, then it makes sense to invest in one. For example, if you are in the automotive, financial services or telecom industries, your customers have a high propensity to use the phone to qualify “considered purchase” decisions.

Explore platform capabilities from vendors like CallRail, Invoca, CallSource, DialogueTech and more in the full MarTech Intelligence Report on enterprise call analytics platforms.

What is our process for analyzing inbound phone conversations?

What kind of data can we pull out of calls? Call analytics platforms use AI- and machine learning-based speech analytics and natural language processing to provide robust insights into call quality, particularly around caller sentiment, tone and intent.

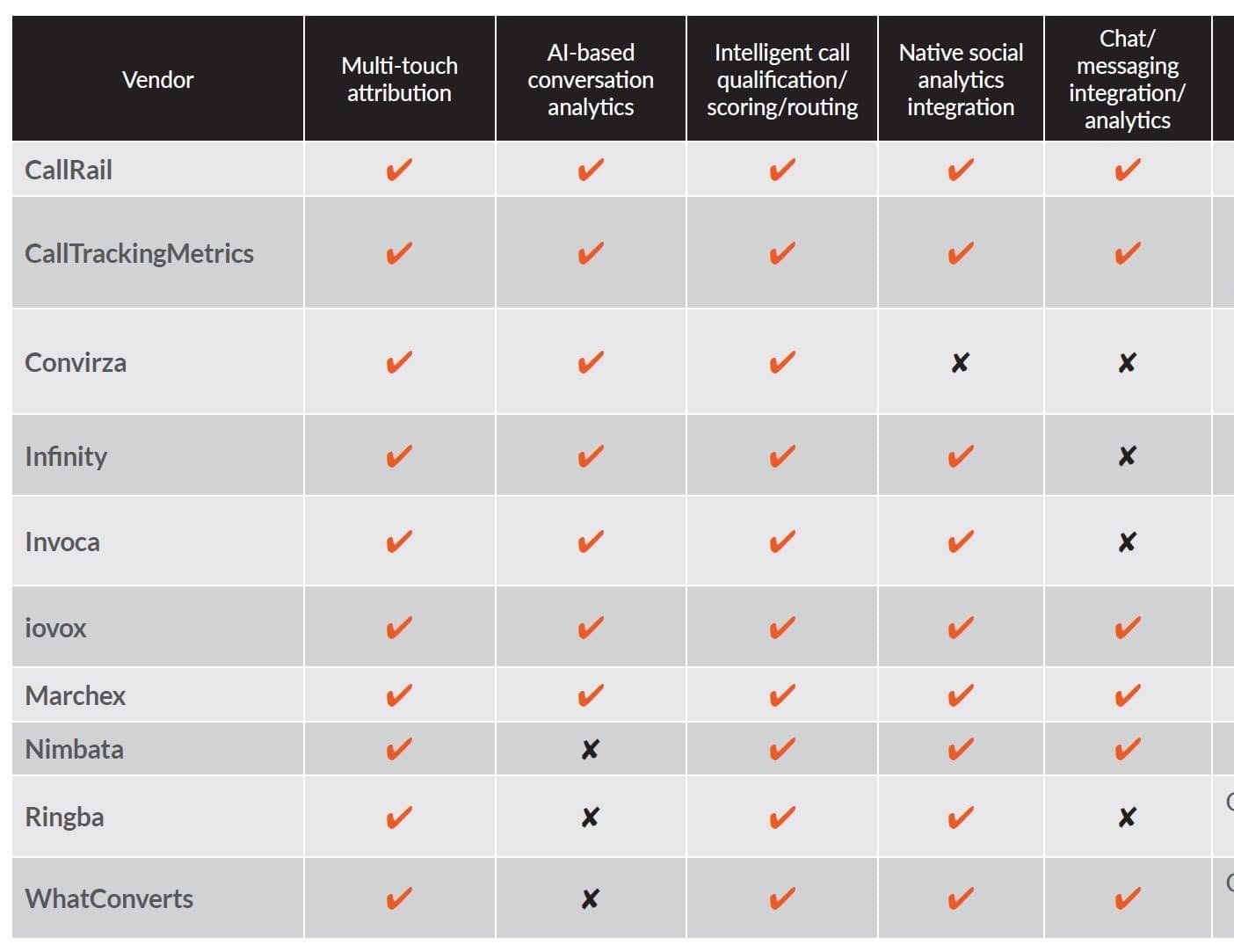

What call analytics capabilities does our organization need?

Prioritize the available call analytics features based on your most pressing business needs. For example, do you need to get started with basic call tracking data? Or send reports to clients (if you are an agency)? Are call conversions, missed opportunities or other in-call metrics most important? Or are pre-call tools, such as intelligent IVR and call routing more critical to your goals? The answers will help your organization choose a vendor that can help you meet your goals.

Who will use the platform? At what level in the organization will it be managed?

C-suite buy-in and appropriate staffing are crucial to the effectiveness of any call analytics platform. Increasingly, martech platforms such as call analytics are being managed by the CMO – and not the CTO or CIO. In either case, without the proper resources in place, the platform can end up becoming an expensive reservoir of untapped data with unfulfilled potential to increase revenue and improve your customer experiences.

How much training will we need?

Different platform vendors provide different levels of customer service – from self-serve to full-serve – and strategic consulting services. It’s important to have an idea of where you fall on the spectrum before interviewing potential partners. Training is essential. If your organization chooses not to hire internal staff, then consider whether you need to use a certified platform partner to effectively use the system.

Can we successfully integrate a call analytics system with our existing martech or ad tech systems?

Many enterprises work with different partners for email, ecommerce, CRM, social media, paid search, SEO and display advertising. Investigate which systems the call analytics vendor integrates with – whether natively or via API – and find out if they offer seamless reporting and/or execution capabilities with them.

What are our reporting needs?

What information do your marketing managers, salespeople, customer support teams and IT departments require to improve decision making? You want to know the specific holes in your current reporting that will be filled by additional functionality and, more importantly, you want to be sure that that extra information derived from call analytics will drive better decisions.

What is the total cost of ownership?

Enterprise call analytics platforms use on-demand pricing, meaning customers pay a monthly subscription fee that will vary by usage. The majority of vendors profiled in this report charge for both phone numbers and minutes. Some have platform and onboarding fees, and some do not. Examine your feature requirements closely, as modular pricing models mean vendors vary in their inclusion of some features as standard or add-ons.

How will we define success?

What KPIs do we want to measure and what decisions will we make based on call analytics data? Set your business goals for the call analytics platform in advance to be able to benchmark success later on. Without them, justifying the expense of the platform or subsequent marketing campaigns to C-suite executives will be difficult.

Our latest report Enterprise Call Analytics: A Marketer’s Guide is available here

Get MarTech! Daily. Free. In your inbox.

About the author

Pamela Parker is Research Director at Third Door Media’s Content Studio, where she produces MarTech Intelligence Reports and other in-depth content for digital marketers in conjunction with Search Engine Land and MarTech. Prior to taking on this role at TDM, she served as Content Manager, Senior Editor and Executive Features Editor. Parker is a well-respected authority on digital marketing, having reported and written on the subject since its beginning. She’s a former managing editor of ClickZ and has also worked on the business side helping independent publishers monetize their sites at Federated Media Publishing. Parker earned a master’s degree in journalism from Columbia University.