Nvidia’s CEO, Jensen Huang, discussed the current debate involving Nvidia and EVGA. Recall that EVGA left the GPU market abruptly and blamed Nvidia’s treatment of it for doing so.

According to Huang, the situation wasn’t as bad as it first appeared, and Nvidia made an effort to protect its partners from the market’s concerns.

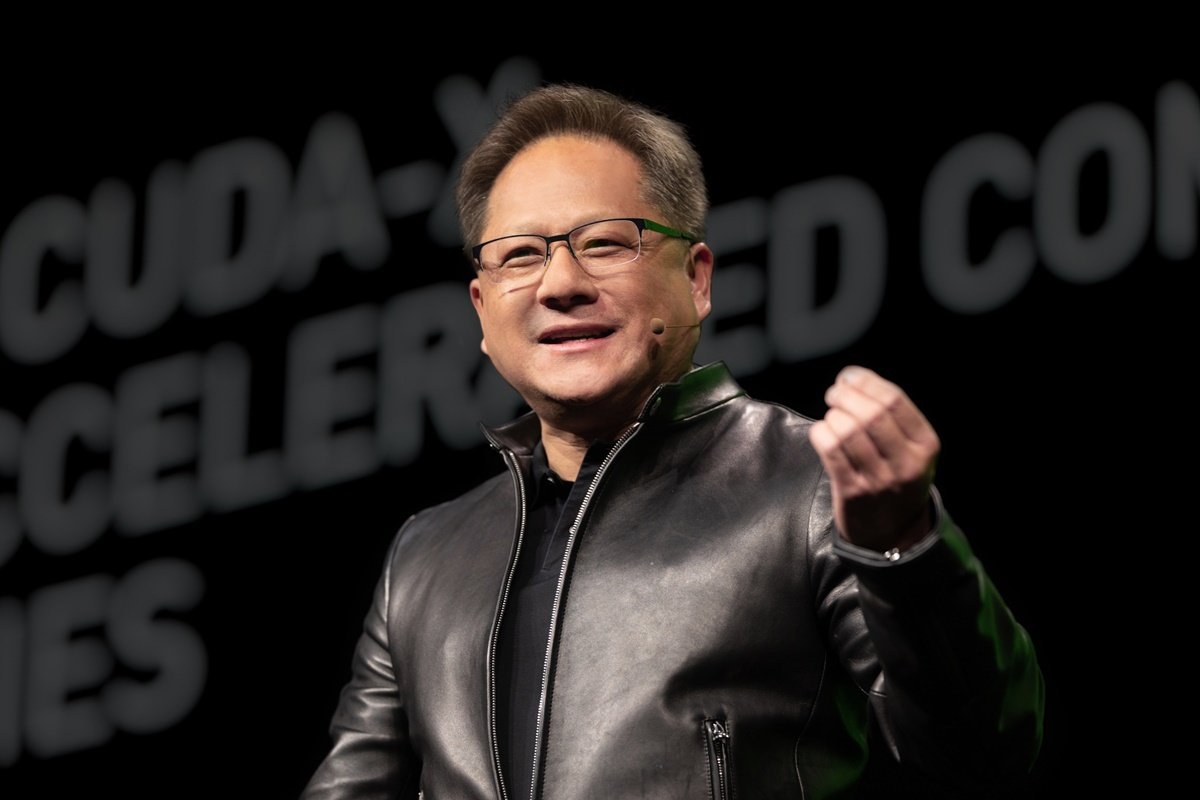

It’s been a challenging week or so for Nvidia. First, it was reported that Nvidia was to blame for EVGA’s decision to cease production of GPUs. The RTX 40-Series was then shown, and the pricing for these GPUs was somewhat disappointing. Last but not least, Jensen Huang acknowledged that GPU costs will no longer decline. Nvidia CEO Jensen Huang has now made a subtly amenable response to the EVGA controversy.

According to Windows Central, Huang addressed the media and discussed both the EVGA problem and the export limits put in place by the US government. Huang appears upbeat that Nvidia has a strong quarter ahead of it and will prevail despite the challenges.

Huang acknowledged that EVGA made the decision to end its relationship with Nvidia, but from the way he stated it, it appears that this was the long-term strategy.

Huang remarked, “Andrew wanted to wind down the business and he’s wanted to do that for a couple of years,” referring to EVGA CEO Andrew Han. Although I’m sorry to see Andrew and EVGA depart the market because they are wonderful partners, he has other ideas that he’s been considering for a while. That’s all there is to it.

The market, Huang continued, “has a lot of outstanding companies,” so it will continue to be well-served even when EVGA departs. Huang responded to EVGA’s complaints about Nvidia by stating that Nvidia was attempting to protect its add-in board (AIB) partners from the present market environment. EVGA’s complaints about Nvidia include things like being unaware of architectural improvements and pricing. Included in this are price hikes and the challenges obtaining components due to the numerous supply chain issues.

The lead times for putting a buy order on a wafer increased significantly during the pandemic, from 16 weeks to a year and a half. At the same time, there was a sharp increase in demand for new GPUs. Nvidia placed large quantities of inventory on order in advance as a result, although the market has now slowed. Nvidia did not, however, charge its AIBs for the extra inventory it now has lying around.

“Our AIBs are nimble,” stated Jensen Huang. “We ordered the components regardless of what. And during the peak of the market, we carried the lion’s share of the inventory. Each of our selling prices remained constant at $1. We continued to incur higher component prices, but we were able to cover them completely. And we gave the market nothing.

The company’s CEO provided additional details on the measures taken to maintain its position and profits after the market demand for GPUs declined: “The combination of the obligations that we made, which prompted [Nvidia] to write down nearly a billion dollars worth of inventory. Secondarily, we invested a few hundred million dollars in marketing initiatives to support the channel’s pricing reset. We should be in a strong position in Q4 as Ada ramps up thanks to these two recent decisions, in my opinion.

Huang also doesn’t seem intimidated by the recent trade limitations imposed by the US government on GPU exports to China. The majority of Nvidia’s clients, in its opinion, won’t be impacted by the new limits, and the company anticipates that it will be able to abide by them while still meeting Chinese market demand.

According to the CEO of Nvidia, the EVGA situation may not be as contentious as it first appeared. Additionally, EVGA’s profitability reportedly lagged much behind those of other AIBs, which may have made the choice simpler. But it’s unlikely that we’ll ever get the whole story, and it’s difficult to gauge just how much animosity may exist between the two businesses.